Notary Bond vs Notary E&O Insurance

Notary Bonds and Errors and Omissions Insurance

What is the difference between a notary bond and errors and omissions (E&O) insurance?

A notary bond is a financial security document underwritten by a surety licensed in the state that requires it. Translated, the bond is there to protect the public in the event of financial damages caused due to improper notarization. A notary bond is not insurance for the notary. If you are forced to pay damages due to a notarization that you performed, the bonding company will pay up to the bond value amount, but the next thing the bonding company will do is come after you for the money. They are very efficient at collecting, which is why the premium cost is relatively low, since the surety does not carry much risk.

| Notary Bond | Notary E&O |

|---|---|

| Required in many states to become a notary | Optional — independent of the commission |

| Fixed amount by statute | Notary can choose coverage amount |

| Insures the “public” | Insures the notary |

In our Online Notary Video Training Courses, we use the example of James Bond 007. Who does James Bond protect? All of the citizens of the world, just the same as the notary bond. Who protects James Bond? He does! What does he use? His brain! He outwits the criminals every movie. So what does the notary use to protect him or herself? Their brain and Errors and Omissions insurance.

We recommend that every notary take one of our training courses because knowledge will help you to avoid legal or financial problems from negligence. Ignorance of the law is not a valid legal defense. Errors and Omissions will cover honest mistakes, however, it will not protect against fraudulent notarization. Just as the name implies, “errors and omissions” only apply. We recommend you purchase the biggest policy you can afford and at least cover the amount of the bond.

How much does a notary bond cost?

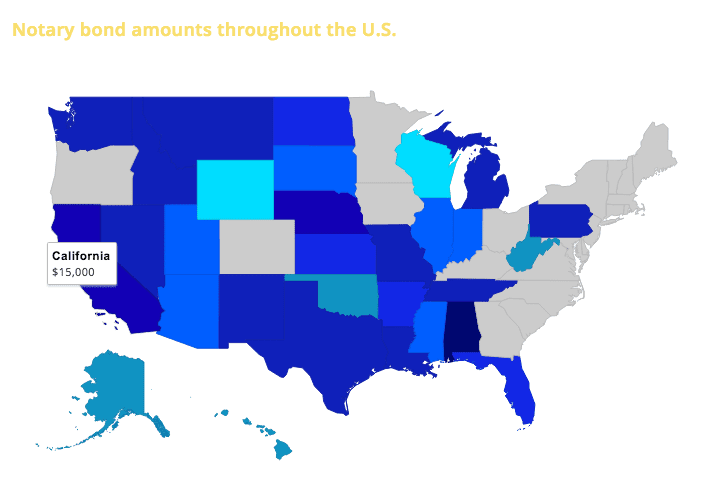

Many people are shocked when they see that they must purchase a $500, $1000, $5000 or $10,000 notary bond. The good news is that the premium amount is a fraction of the face-value bond amount. The bond amount is determined by state statute. You have no choice in the bond amount. Each state’s legislature has determined the amount they deem necessary. Wisconsin and Wyoming are on the low end at $500 while Alabama is the highest at $25,000 and the rest of the states that require bonds are in between there. The difference in premium price between the lowest premium cost is $30 and the highest is $110! Why would a state choose the lower end versus the higher end? It usually depends on trying to keep premium prices reasonable while also protecting the financial interests of the general public.

As far as errors and omissions insurance is concerned, the amount you should purchase is determined by both your financial risk and the type of documents you will be notarizing. If you are working as a loan signing agent, you would likely want at least $50,000 and seriously consider $100,000. Many loan signing companies and title companies will require $100,000 or more in order for you to do business with them. If you are notarizing lower risk documents, then covering the bond amount should be sufficient.

Notary bond amounts throughout the U.S.

Bonds Map

Leave a Reply

You must be logged in to post a comment.